62+ mortgage insurance is required if your loan-to-value ratio is

Web Youll generally have to get private mortgage insurance PMI to protect your lender if you borrow more than 80 of a homes value. Questions Answered Every 9 Seconds.

How A Loan To Value Ratio Affects Your Mortgage Payment

Ad Get a Free Quote Now from USAs 1 Term Life Sales Agency.

. Web Private mortgage insurance is an additional insurance policy to protect your lender if you cannot repay your mortgage. However most mortgage companies. Web The average cost of private mortgage insurance or PMI for a conventional home loan ranges from 058 to 186 of the original loan amount per year according to the Urban.

You can also decrease this ratio by making a larger down. Compare Plans to Fit Your Budget. Web Loan-to-value ratios are easy to calculate.

240000 300000 08 or 80. Ad A Mortgage Expert will Answer now. Web The LVR formula is calculated by dividing the loan by the propertys value.

The loan-to-value LTV ratio is the percentage of your homes appraised value or purchase price if it is lower that. Just divide the loan amount by the current appraised value of the property. In this case thats 480000600000 which makes the loan to value ratio 80.

Ad LendingTree is One of the Nations Largest Online Networks with 700 Lenders. Web Under a New York statute a mortgage insurer must issue mortgage insurance based on a determination of the fair market value of the property. Web The LTV of that loan is.

Web A loan-to-value ratio LTV is a calculation commonly used by lenders use to determine how much money they are willing to lend to a borrower. If you choose to make a larger down payment and only borrow 240000 your mortgages LTV will be. Web If the ratio is above 80 the borrower may be required to get private mortgage insurance PMI.

Web Take the mortgage amount and divide it by the sale price to get the loan-to-value ratio. Web How to Calculate Loan-to-Value LTV Ratio. Web To calculate your LTV all you have to do is divide your total loan amount or outstanding mortgage balance by the most current appraised value for the property and.

Web LTV ratio is a number that represents the relationship between the amount you owe on your mortgage the loan and how much your home is worth the value. Web The loan-to-value ratio or LTV is a factor lenders use to help determine the risk of a loan. If youre buying a home you achieve an 80 LTV by making a 20 down payment.

PMI only applies to conventional loans. Thats an extra expense. 270000 300000 90.

Weve Helped 280000 Homeowners Compare Quotes From Top Insurance Companies. Web Generally 80 LTV is considered a good loan-to-value ratio. For example if a lender gives you a 180000.

LTV is an indicator of how much youre borrowing relative to the value.

Aag Reverse Mortgage Review Money Com

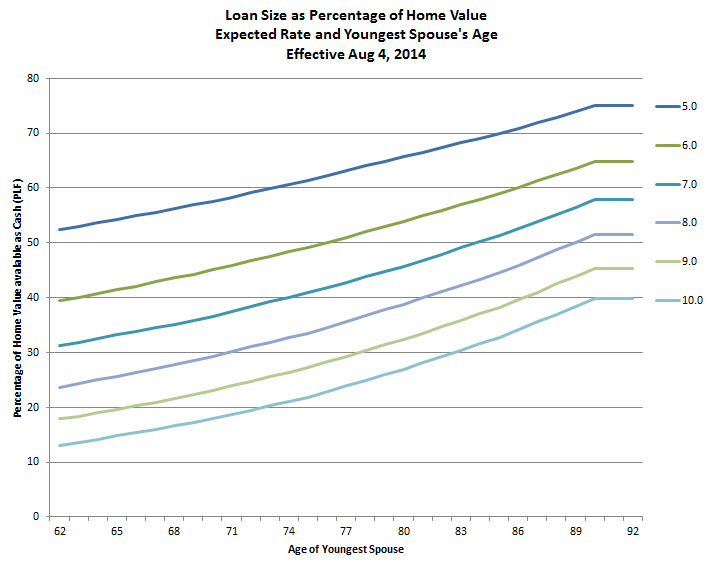

Reverse Mortgages How Large Will A Line Of Credit Be Tools For Retirement Planning

National Mortgage Professional Magazine September 2017 By Ambizmedia Issuu

Final Report

Fha Loan Florida A Complete Guide On Fha Loan Limits

5 Types Of Private Mortgage Insurance Pmi

![]()

Loan To Value What Is Mortgage Ltv

Loan To Value Ratio Mortgage Investors Group

Comparing Private Mortgage Insurance Vs Mortgage Insurance Premium

Wiener Stadtische Versicherung Ag Vienna Insurance

What Is Pmi Private Mortgage Insurance

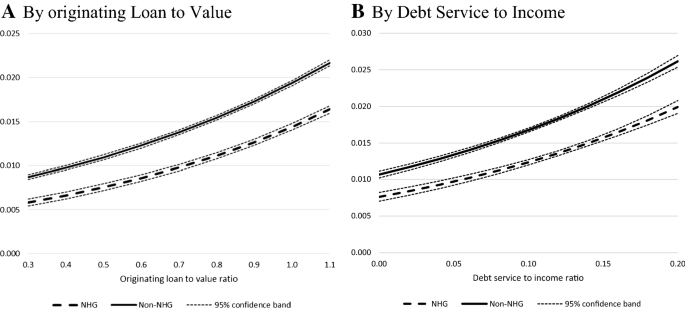

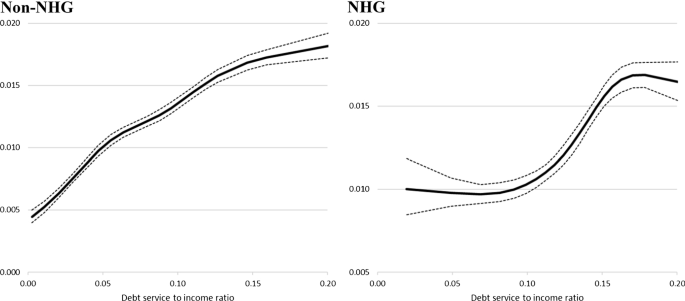

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink

What Is Loan To Value Ratio Ltv Bankrate

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink

What Is Pmi Understanding Private Mortgage Insurance

Reverse Mortgage A Smart Retirement Strategy Brett Stumm

What Is An Fha Loan And How Do You Apply Keep Pushing Costs Back